Situation of the Group

Business model of the Group

Situation

Flughafen München GmbH (FMG) is headquartered in Munich. As the senior parent company of the Munich Airport Group (Munich Airport), it is the operator of Munich’s passenger airport.

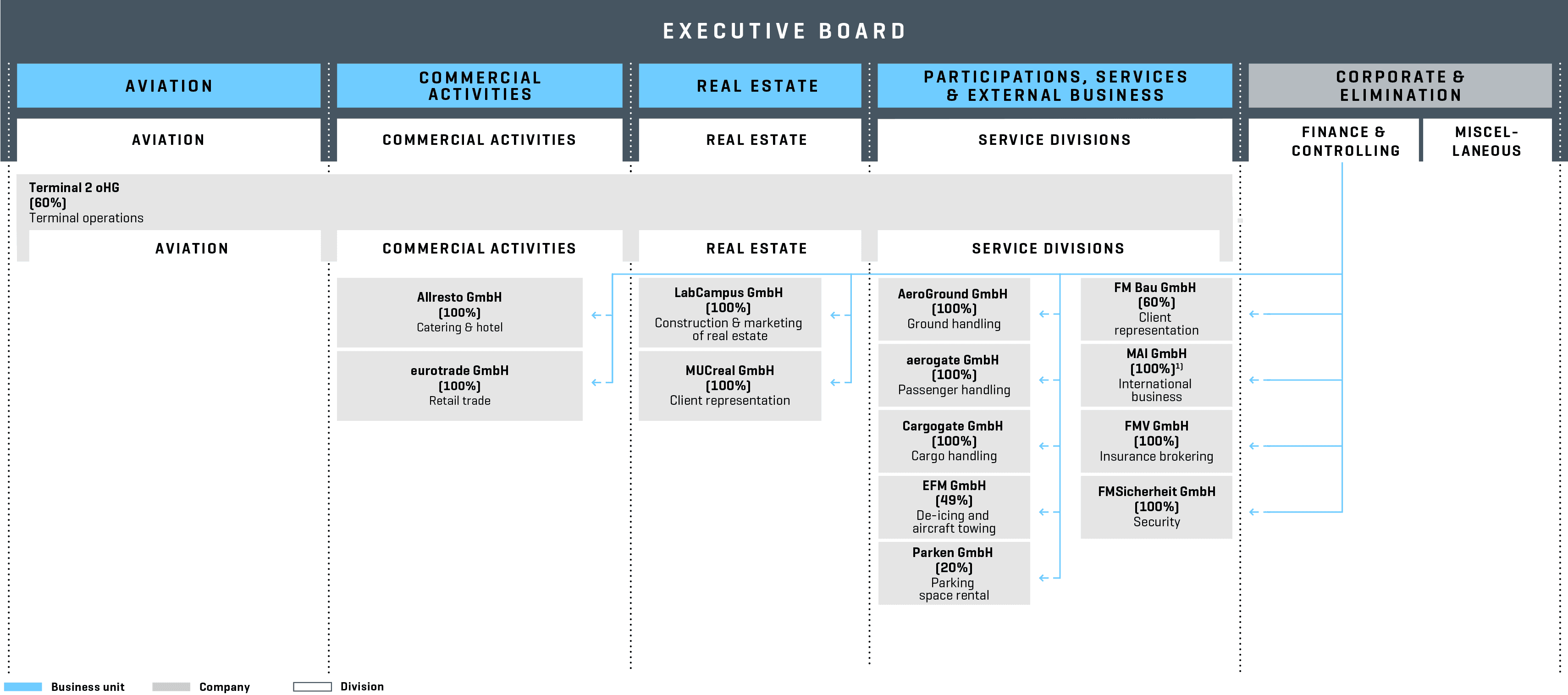

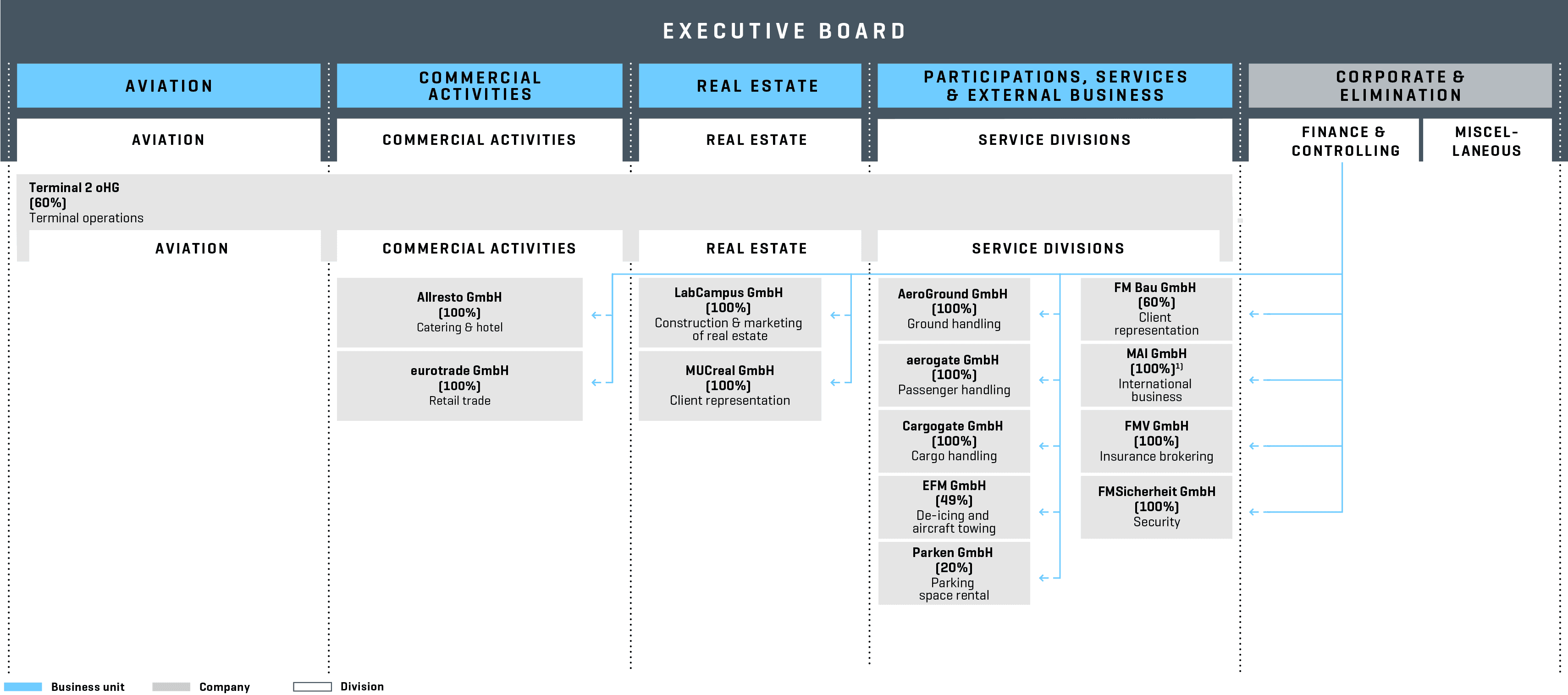

Munich Airport is active via the business units Aviation, Commercial Activities, Real Estate and Participations, Services & External Business. The service profile of the Group covers virtually all the services available on the airport campus – from flight operations to passenger and cargo handling through to retailing, hotels, and gastronomy. This integrated business model and depth of added value sets Munich Airport apart from its European competitors.

Munich Airport is committed to a corporate policy of sustainability. The orientation toward economic, environmental, and social goals ensures acceptance of the airport and consequently the viability of its business model.

Main features of management and control

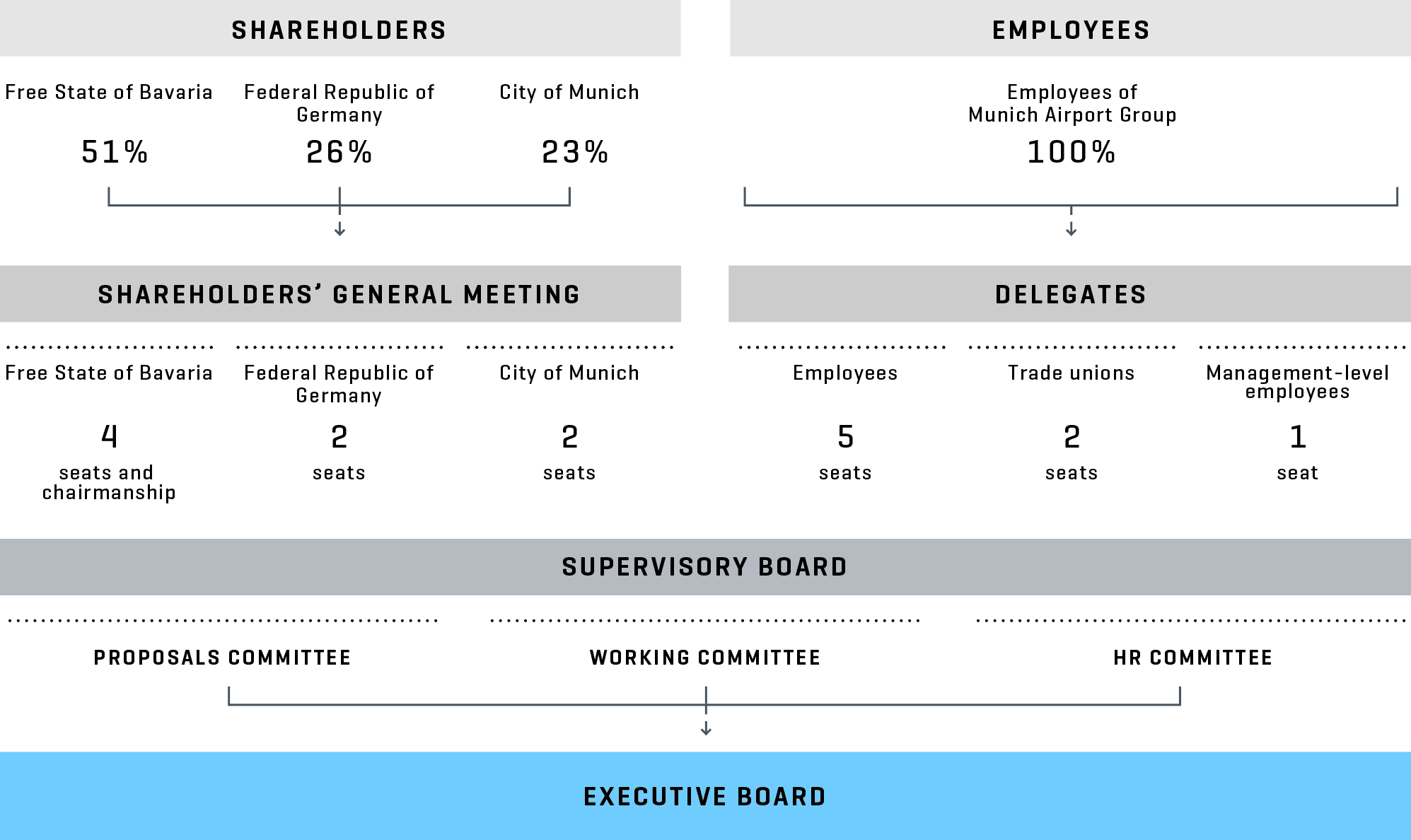

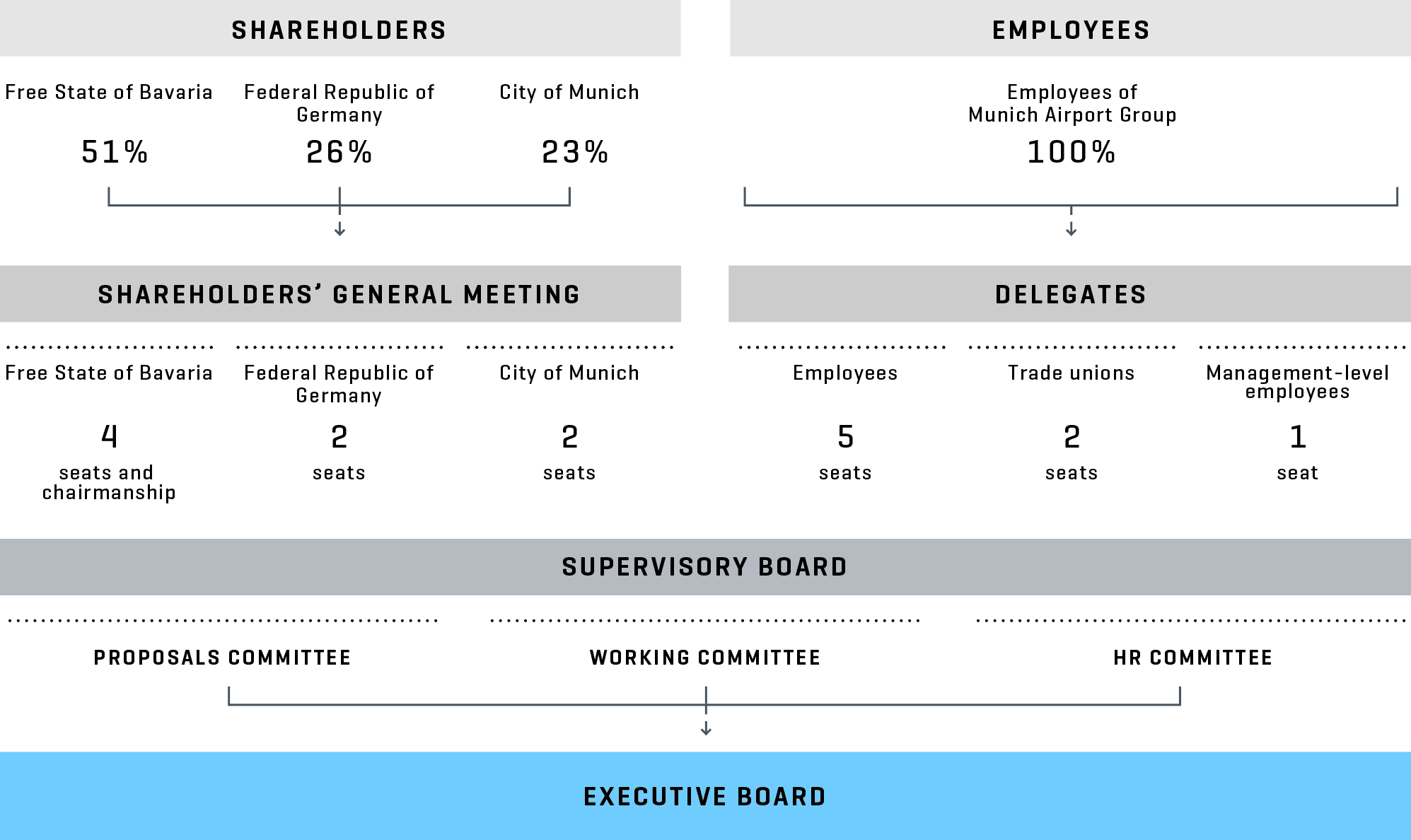

The shareholders of FMG are the Free State of Bavaria with 51.0 %, the Federal Republic of Germany with 26.0 %, and the City of Munich with 23.0 %.

According to section 5 of FMG’s Articles of Association, its executive bodies consist of the Executive Board, the Supervisory Board and the Shareholders’ General Meeting.

Executive Board

As a rule, the members of FMG’s Executive Board are appointed for five years. Re-appointments are permitted. The Executive Board consists of three members (including the Chairman of the Board), represents FMG externally and is responsible for corporate policy and the strategic direction of the Munich Airport.

The members of FMG’s Executive Board receive non-performance-related compensation (fixed salary) and performance-related remuneration with short- and medium-term incentives (bonus). The bonus is primarily linked to the earnings before taxes.

Supervisory Board

FMG has a Supervisory Board pursuant to Sections 1 (1) and (6) of the German Codetermination Act [Mitbestimmungsgesetz – MitbestG]. The Supervisory Board exercises monitoring and co-determination rights. It appoints members of the Executive Board and determines their remuneration. Transactions exceeding certain thresholds or terms require Supervisory Board approval. The employee representatives in the Supervisory Board are elected by FMG employees every five years. The shareholders’ representatives are appointed by the shareholders’ general meeting. The term in office of the Supervisory Board members ends with the Shareholders’ General Meeting that resolves on the formal discharge of the members for the fourth financial year after the start of their term in office.

The Supervisory Board has appointed a proposals committee, a working committee and an HR committee, and it has entrusted them with the following tasks, among others:

Committees in the Supervisory Board

| Proposals committee | Fulfillment of tasks pursuant to Section 31 (3) of the German Codetermination Act (MitbestG) |

| Working committee | Comments for draft resolutions that require the approval of the Supervisory Board; approval in lieu of the Supervisory Board for certain legal transactions that exceed fixed value limits or terms |

| HR committee | Drafts the contracts of the Executive Board except for remuneration, the fully authorized representatives and the authorized officers; approves the definition of and changes to remuneration rules outside of collective agreements. Approves the introduction of and changes to salary levels of certain employees and company pension benefits. |

Shareholders’ General Meeting

The Shareholders’ General Meeting is the highest monitoring and decision-making body. Central decisions on the business and economic fundamentals of the Group (including airport expansion and borrowing of loans) must be adopted unanimously.

Group declaration on corporate governance – Information about the proportion of women

In the context of ensuring the equal participation of women and men, the Supervisory Board and Executive Board of the parent company FMG stipulate targets and deadlines for the proportion of women on the Supervisory Board, Executive Board, and on the first two management levels.

A target of 25 % women has been set for the Supervisory Board by June 30, 2024. The employee representatives on the Supervisory Board are elected, while the shareholder representatives are mainly appointed on a function- specific basis. In this respect, the possibility of directly influencing the proportion of women in the Supervisory Board is limited.

The current proportion of women on the Executive Board of 33 % is to be maintained until June 30, 2024.

A target level of 25 % by June 30, 2024 has been defined for the first management level; the figure for the second-highest management level is 30 %.

Governance structure

Activities

Organizational structure

The Group’s organizational structure is divided into FMG’s business, service and corporate divisions. The management and internal reporting of the business units is primarily handled by FMG’s group management. The business units shown in the figure comprise the business and service divisions of FMG and the Group companies integrated in the business units. The business units are explained in the following sections.

Organizational structure of Munich Airport

Business, service and corporate divisions (as of Dec. 31, 2023)

- Munich Airport International GmbH has a 100 % equity interest in Munich Airport US Holding LLC and amd.sigma strategic airport development GmbH, as well as a 50 % equity interest in ORAT AMS Group V.O.F. Munich Airport US Holding LLC in turn has a 100 % equity interest in Munich Airport NJ LLC.

InfoGate Information Systems GmbH was merged with FMG on January 1, 2023. Also on January 1, 2023, the occupational medicine division was integrated into FMG before the shares in MediCare Flughafen München Medizinisches Zentrum GmbH were sold.

There were no other fundamental changes to the organizational structure in the 2023 fiscal year. A detailed overview of the ownership structure is included in the notes to the consolidated financial statements.

As of December 31, 2023, the Group comprises the parent company, 14 fully consolidated companies, one associate, one joint operation, and two companies that are not consolidated. These are directed by operational and strategic Corporate Controlling and Investment Management in line with the business division strategy assigned in each case.

Aviation business unit

Infrastructure for airlines and passengers

The Aviation business unit covers the operation of Munich Airport’s air traffic infrastructure.

Munich Airport operates two runways with a maximum capacity of 90 aircraft movements per hour during daytime operations at normal capacity. This capacity was exhausted for long stretches in normal operations in the years before Corona. Between 10 p.m. and 6 a.m., flight operations are only permitted to a very limited extent and only with particularly low-noise aircraft. Flights are not allowed between 12 midnight and 5 a.m., with the exception of emergency and medical aid flights, landings required for reasons of air safety, as well as flights in justified exceptional cases that are approved by the Bavarian Ministry of Housing, Building, and Transport as the competent authority.

The Aviation division of FMG is responsible for operating Terminal 1 at Munich Airport, while Terminal 2 is operated by Terminal 2 oHG – a partnership between FMG and Deutsche Lufthansa AG (hereafter referred to as «Deutsche Lufthansa»). Both terminals will be continuously optimized and expanded as needed. The pier at Terminal 1, for which interior construction started in 2023, is supposed to meet the requirements for efficient security checks and terminal infrastructure when it opens in mid-2026, enabling Munich Airport to maintain and improve its status as a premium hub with a corresponding quality of stay.

Various charges are levied for the provision and operation of these air traffic facilities. In the 2021 fiscal year, the new framework agreement on charges (ERV) came into force with uniform provisions for all airlines, which fundamentally regulates the development of air traffic charges up to and including 2030 and thus ensures the refinancing of infrastructure to a defined extent. In 2023, charges increased by 4.1 % on average, as per the ERV.

Munich Airport is strategically well positioned thanks to its central location in Europe in the middle of the Munich metropolitan region, which is characterized as a center of innovation, knowledge and business with a broad-based industry structure. However, growth in population and employment in the economically important airport region has slowed as a result of the coronavirus pandemic. 1) While international hub traffic resumed as early as summer 2022, the gradual recovery in air traffic is also becoming evident in the business travel segment. Despite the pandemic-related losses, the demographic and economic conditions in Bavaria and especially in the airport catchment area suggest that transportation demand at Munich Airport will continue to grow in the medium to long term. Further comments on this topic can be found in the section «Economic environment».

Over the years, Munich Airport has developed into a major air traffic hub in cooperation with Deutsche Lufthansa. Jointly supported expansion measures such as Terminal 2 and the satellite building, as well as the on-going stationing of Lufthansa’s Airbus A350 long-haul fleet in Munich, are the foundations of a sustainable partnership that stands for long-term growth. The stable demand at this location is also evidenced by the return of all remaining Lufthansa Airbus A380 aircraft.

Thanks to its promising market position and successful cooperation with Lufthansa, prior to the COVID-19 crisis Munich Airport had one of the most extensive networks of intercontinental connections in Europe, measured in terms of the number of destinations. In the 2023 summer timetable, the number of routes was about the same as in 2019; only the number of frequencies was lower for some destinations.

The combination of a dense network of German domestic and European links and strong local demand means that Munich Airport can once again offer an attractive portfolio of long-haul flights. Due to the attractiveness of the location for tourists and the growing catchment area with an affluent population, Munich Airport has also become an attractive location for point-to-point connections.

According to a forecast by the International Air Transport Association (IATA), global traffic is expected to return to 2019 levels by 2024. 2) Lufthansa anticipates that by then, it will once again operate a hub airport at Munich Airport with approximately 33 long-haul aircraft stationed there. The German aviation tax and protectionist measures – particularly the lack of traffic rights – continue to hamper market-driven growth at Munich Airport.

Cargo handling at Munich Airport is heavily dependent on the development of passenger traffic. The reason for this is that, as a rule, the majority of airfreight at Munich Airport – over 80 % – is transported as bellyhold cargo on regular long-haul flights. However, globally speaking, the share of bellyhold cargo as a proportion of airfreight volumes is only around 50 %. 3)

Commercial Activities business unit

First-class service and promotions along the passenger route

The Commercial Activities business unit is responsible for developing, marketing and managing all space throughout Munich Airport that may be used for commercial purposes.

This includes supplying demand-oriented parking space capacities. At present, there are approximately 33,300 parking spaces, of which some 20,100 are close to the terminal. In addition to regular passenger parking, the product portfolio also includes the rental car business, premium parking and tenant parking, as well as landside transfer operations.

It is also responsible for strategically planning the sector mix with regard to the retail, service, and gastronomy space, as well as leasing and granting of concessions to third parties and Group companies.

Munich Airport maintains approximately 18,900 m² of gastronomy space (previous year: 18,750) and some 17,600 m² of retail and service space. FMG subsidiaries operate their own retail or gastronomy businesses on approximately 76 % of the total area.

Commercial Activities is also responsible for the five-star hotel in Munich Airport’s central area. It has 550 rooms and 30 conference rooms.

Commercial Activities also markets the advertising media and spaces at Munich Airport. The offer of what is known as out-of-home advertising at Munich Airport is characterized by high-profile advertising spaces with little wastage, which are tailored to clients’ individual requirements.

The business unit’s service portfolio also includes the event business.

Real Estate business unit

Real estate location with attractive appeal

The Real Estate business unit develops, operates, and markets all real estate and property owned by Munich Airport, both on and off-campus. The real estate location is divided into location-specific areas, which are marketed under the AirSite concept. Munich Airport has a lot to offer as a real estate location: an attractive environment, good road connections, excellent parking and a comprehensive range of goods and services for daily needs.

In accordance with the high demands placed on the entire area, an urban planning concept was developed that is continuously updated and that is already visible with the construction of the first high-rise buildings, with some already in operation.

Participations, Services & External Business business unit

Participations & External Business: Full-Service-Provider

The other companies in the Group complement the range of services offered by the airport. The most significant subsidiaries are:

Significant subsidiaries

| AeroGround | AeroGround Flughafen München GmbH (AE Munich) provides land and airside handling services for airline customers on site. The main business units include the classic ground handling services of aircraft loading and unloading (ramp and baggage handling), transport services for passengers and crews, ramp-side cargo transport as well as central infrastructure services. |

| aerogate | aerogate München Gesellschaft für Luftverkehrsabfertigungen mbH offers passenger handling, operation services with ramp supervision, ticketing services and lost & found with baggage delivery and arrival services at Munich Airport. The range of services is completed by general aviation services as well as consultancy and training. |

| Cargogate | As a regulated agent, Cargogate Munich Airport GmbH performs services related to the handling of airfreight and the processing of the associated customs formalities. Cargogate also offers handling services for all common special goods, such as hazardous substances, refrigerated goods and valuable goods. Cargogate is certified to provide handling services for pharmaceuticals. As a proven specialist, the company operates the border inspection post required by the EU and the airport-wide Animal Reception Center on behalf of Munich Airport; it also supplies the animal protection officer for Munich Airport. |

| MAI | Munich Airport International GmbH (MAI) and its affiliates provide management, consulting and training services for the aviation industry worldwide. |

Services: Energy, IT and digital for all tenants at the airport

Besides the business units and subsidiaries, Munich Airport’s service divisions are also involved in external sales. The largest contribution comes from the following service divisions:

Significant service divisions

| Technology | The service division is responsible for the secure and economical technical operation of the airport infrastructure. Among other things, this includes the supply of energy, maintenance of buildings and airport-specific equipment, as well as vehicle management. In addition, this division plays a key role in implementing Munich Airport’s CO2 strategy as part of its energy supply, energy savings and energy management activities. |

| IT | The service division is the main IT provider for Munich Airport. It provides modern, reliable and integrated solutions for increasingly process- and data-supported airport operations. The IT service portfolio comprises various services from the fields of media and communications technology, workplace IT equipment, as well as server, database, and storage system technology. The division’s core competencies lie in the integration of different technical IT platforms and the provision of customized technical system solutions to support logistics processes at Munich Airport. As part of the digital transformation, the service division actively supports change processes for the further or new development of digital business models. Compliance with security and data protection requirements and Group-wide uniform standards is gaining in importance. |

The activities in the Participations, Services & External Business unit (excluding handling services) account for a small share of the Group’s external revenues, therefore a detailed explanation is not provided in the section «Economic environment». Developments relating to handling services in the Group have been included in the passages under «Aviation business».

Control system and values management

Munich Airport measures the performance of its managers with the help of material financial and non-financial key figures. Earnings before taxes (EBT) covers the financial perspective. Non-financial key figures include the Passenger Experience Index (PEI), carbon reductions and the Lost Time Incident Frequency (LTIF).

Earnings before taxes (EBT)

Earnings targets for managers are formulated on the basis of EBT.

EBT is the input factor for determining profitability. It relates to the consolidated earnings before taxes, calculated by applying the International Financial Reporting Standards in the version adopted into European law by the European Commission.

Passenger Experience Index (PEI)

The PEI is a measurement model for customer satisfaction, which allows Munich Airport to derive location-specific targets adjusted to the needs of target groups, and to assign the fields of action for improving service to existing customer contact points. Responsibility for determining these values lies with an independent external service provider for reasons of objectivity. Using questionnaires, the provider surveys the satisfaction of departing and arriving travelers on a regular basis over the course of the entire year. On a quarterly basis and at the end of the year, Munich Airport thus receives a great deal of detailed information about the satisfaction of its passengers in eight categories along the passenger experience chain. One key figure follows from the question about general satisfaction, which is queried for both departing and arriving passengers and which forms the basis for the target definition.

Carbon reductions

In 2023, Munich Airport adopted the climate objective «net zero emissions», which means that the operation of the airport would no longer emit CO₂ into the atmosphere by 2035. To this end, emissions (Scope 1 and Scope 2) that the airport has some control over are supposed to be reduced by at least 90 %. The remaining 10 % would be actively and permanently removed from the atmosphere through projects that must still be selected (so-called removal).

The net zero emissions strategy (base year 2016) is a further innovation of the previous CO₂ strategy. Emissions caused directly by Munich Airport itself through energy supply and fuel consumption (Scope 1), and emissions arising from purchased energy (Scope 2), are factored into the calculation. The key figure «carbon reductions» measures the reduction in emissions resulting from the targeted implementation of carbon reduction measures. Measures (e.g. switching over to high-efficiency engines) that are designed to ensure recurring annual energy savings (electricity, heat, cooling, fuel) are implemented every year. The energy volumes that are saved as a result reduce CO₂ emissions for the following years. Factors such as the conservation of resources or the efficient use of energy can also be taken into account in this context. Depending on the data basis, the savings are determined on the basis of measurements, product data sheets or performance data on nameplates, and they are documented in the carbon database. In exceptional cases, experience values of comparable measures that have already been completed and verified are used. The savings that are calculated are extrapolated for the entire fiscal year.

To facilitate comparisons between the projected and achieved target values, Munich Airport uses the emission factor from the German Environment Agency (UBA), which is available at the beginning of the reporting year.

Lost Time Incident Frequency (LTIF)

The LTIF represents the benchmarkable Lost Time Incident Frequency. It relates the number of occupational accidents to the number of hours worked. Only occupational accidents with a lost time of one day or more are included in the determination of the LTIF. Accidents when traveling from and to the workplace are not taken into account. The key figure is collected for the two Group companies with the largest number of employees (FMG and AE Munich).

The control intention is to reduce the frequency of occupational accidents, accident-related absenteeism and the associated accident costs, as well as to raise awareness of the accident issue as a whole.

Digital transformation and innovation

The digital transformation is a very important strategic issue for Munich Airport, which must be actively shaped in the coming years. The main themes of the updated digital strategy comprise the following:

Innovation management should systematically promote the innovation culture in the company and support the implementation of the corresponding projects. The main emphasis is on new services and products that contribute to Munich Airport’s economic success and strengthen its competitiveness.

For this purpose, Munich Airport uses various cross-departmental sources and initiatives that are used to track and analyze relevant market and technology trends together with experts from the specialist departments. The goal is to identify trends early on that have the potential to innovate Munich Airport’s business, and to identify development opportunities for new products and services.

Digital strategy

- Prognos Zukunftsatlas 2022

- The ATW 2023 Forecast Special Report

- Air cargo traffic by type – belly cargo & main cargo 2019 – Statista