Report on economic position

Economic environment

Macroeconomic environment

Subdued economic development

Both national and international economic development are crucial for a global air traffic hub such as Munich Airport.

In 2023, high inflation rates, continued high energy prices and the restrictive monetary policies adopted by many central banks put pressure on the global economy. There was a significant rise in interest rates in many parts of the globe. Industry and private consumption suffered as a result, and economic uncertainty increased. Nonetheless, the global real gross domestic product (GDP) grew by 2.7 % in 2023 (2022: 2.7 %), which was 1.1 % above the previous year’s forecast. 4)

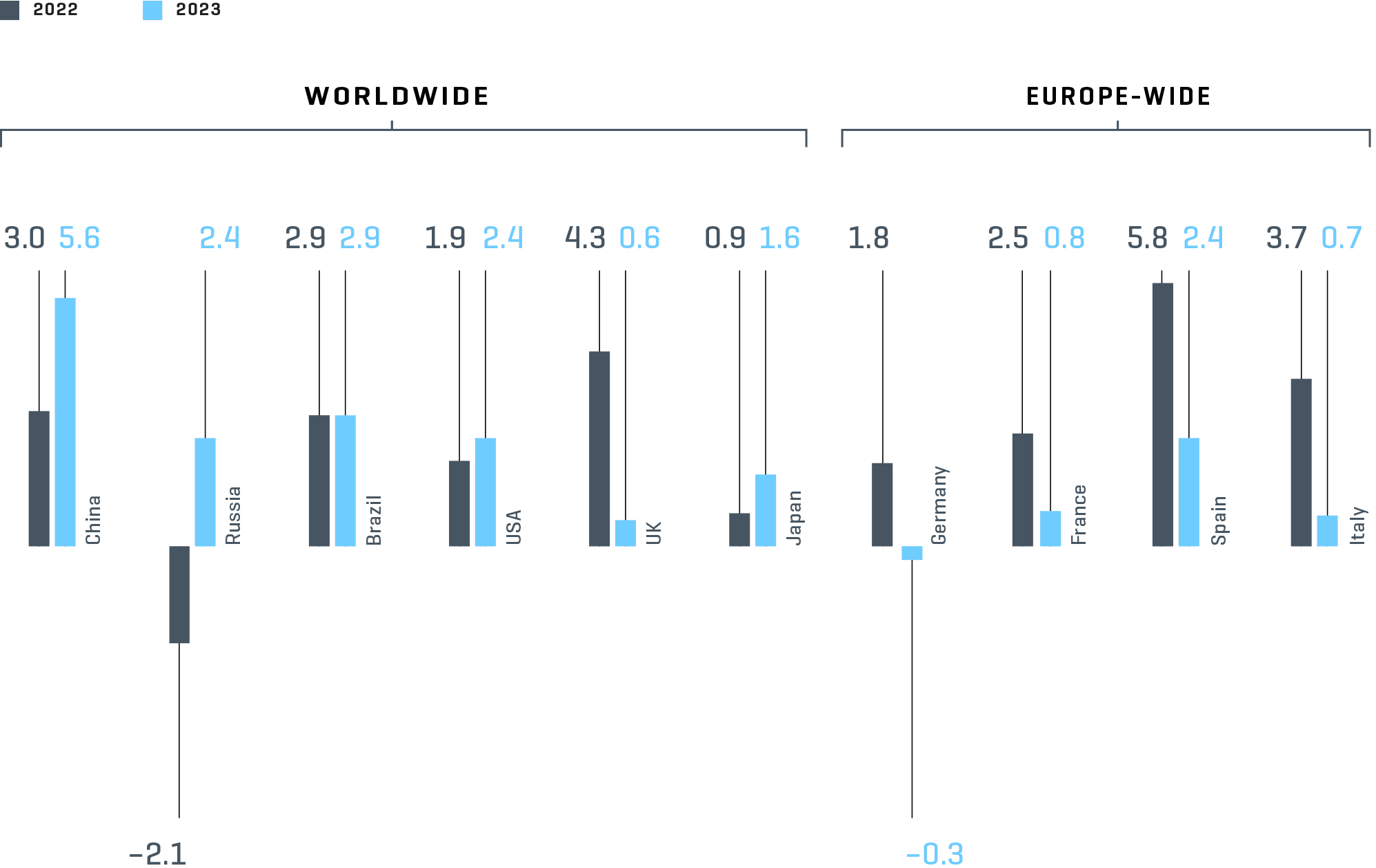

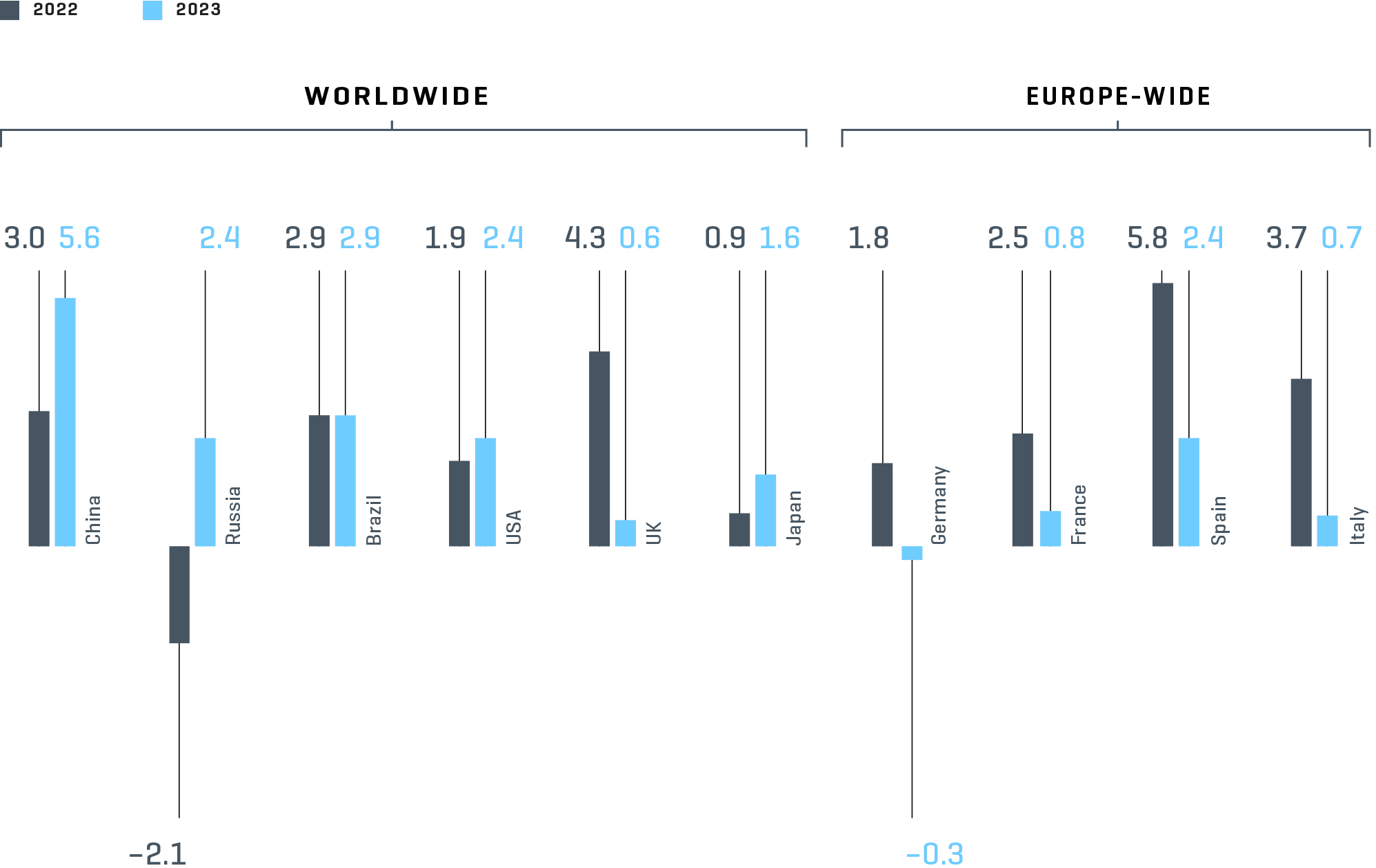

In the emerging markets, the economy grew at an overall rate of 5.0 % (previous year: 3.2 %). The economy of the People’s Republic of China was also negatively affected by the persistent real estate crisis, decreasing foreign trade and relatively weak domestic demand. Positive effects came from the end of the strict zero-COVID measures. Overall, China’s GDP still grew by 5.6 % (2022: 3.0 %). In the Asian region, it was mainly India that contributed to strong growth with a rate of 6.8 % (2022: 6.7 %). 4)

Economic growth of selected countries

GDP growth 2022 and 20231) (in %)

- ifo Institute, Economic Forecast Winter 2023, December 2023

The economies of the industrial nations suffered from the effects of high inflation and significantly higher consumer prices. Central banks increased key interest rates during the course of the year, which put pressure on private consumption and investment activity. Overall, the leading economies recorded only a small 1.5 % increase in the GDP (2022: 2.5 %). Positive effects came from the US economy, where the GDP grew by 2.4 %. Here, economic activity was primarily supported by strong private consumption. The British economy, on the other hand, only grew by 0.6 %, following a strong performance in 2022 (+4.3 %). Private consumption there was weak due to high inflation. 4)

The economy in the euro zone grew slightly by 0.5 %. High inflation rates had the effect of decreasing real disposable incomes and consequently put a damper on private consumption demand. In 2023, industrial economy was still burdened by the effects from the energy price shock of the previous year. The monetary policy pursued by the European Central Bank (ECB) became much more restrictive. Key interest rates increased significantly as the year progressed. Investment activities were also curtailed by higher interest rates. The European labor market continued to be robust. As a result, the unemployment rate was relatively low based on a long-term comparison. 4)

The energy crisis of the previous year and high inflation rates had a profound negative impact on the German economy in 2023. While the inflation rate decreased over the previous year (8.7 %), it was still 6.0 % on average during the year, well above the target of 2.0 %. Real wages also increased again as a result of higher wage contracts. Private consumption did not recover as people continued to save (–1.1 %). Foreign trade also declined due to weak global economic activity, and imports and exports fell by 3.2 % and 2.0 % respectively. Gross fixed asset investments saw little growth due to a weak construction sector (+0.2 %). Compared to the previous year, the unemployment rate rose by 0.4 percentage points to 5.7 %. Overall, Germany’s GDP for 2023 shrank by 0.3 %. 4)

In 2023, the oil price (Brent) fluctuated in a range between USD 70 and USD 96 per barrel. The price reached its highest point in the middle of September, and the lowest point in the middle of March. At the end of the year, the oil price was around USD 77 per barrel. 5)

Economic environment air traffic (Aviation)

Significant recovery in traffic

According to data from IATA, which is based on revenue passenger kilometers (RPK), in 2023 global passenger traffic reached 94.1 % of the level before the crisis (2019). Compared to the previous year, this represents an increase of 24 %; the capacity utilization of aircraft reached 82.3 %. Developments in Europe were positive, as the RPK increased by 20.2 % and utilization by 84.4 %. Still, supply in Europe lagged the 2019 reference year by 4.8 %. 6)

According to IATA, 2023 was a difficult year for the global airfreight industry. Even so, a recovery trend was once again visible in the market by the end of the year. «Cargo Tonne Kilometers» (CTK) did not reach the level of the previous year (–1.9 %), which means that the extra supply of 11.3 % (Available Cargo Tonne Kilometers) could not be sold. Compared with the levels seen before the crisis (2019), 96.4 % of freight volumes were achieved. 7)

The press reports of the industry association Airport Council International (ACI) Europe ended with a positive conclusion and only noted a small decrease of 4.5 % in passenger traffic compared to the 2019 reference year. The reports referenced negative factors such as high inflation, expensive tickets and geopolitical tensions. 8)

In its «European Aviation Overview 2023», air traffic control service provider Eurocontrol outlined the development of flights and flyovers in Europe, taking the pre-crisis levels into account. It found that 92 % of the 2019 reference year was reached in the observation period, although Germany as the third-largest market only reached approximately 80 %. On the other hand, Greece (+9 %), along with Turkey and Portugal (each +8 %) were already well above pre-crisis levels. According to Eurocontrol, the situation in Germany is due to a stagnating domestic transport sector, as well as hub traffic that did not reach the level of the pre-crisis period. In terms of the airlines, low-cost airlines Wizz Air (+37 %) and Ryanair (+21 %) experienced the biggest recovery compared to 2019 (point-to-point traffic). Deutsche Lufthansa, on the other hand, was still 24 % below pre-crisis levels. 9)

The German Aviation Association (BDL) expressly referenced the below-average growth of air traffic in Germany, mainly because of higher government site costs. The lack of point-to-point traffic, which only reached 68 % of pre-crisis levels, was noted as a consequence of government intervention. In the rest of Europe, point-to-point traffic already exceeded the levels seen in 2019 (115 %). Within Germany, domestic traffic growth showed the greatest weakness outside of the Frankfurt and Munich hub airports. It only reached 25 % of pre-crisis levels during the reporting year. Generally speaking, the aforementioned hub airports benefited from the recovery in long-haul and connecting traffic. While continental feeder services grew by 14 %, they only reached 61 % of 2019 volumes. The competition-distorting burdens within the EU led to a further shift of traffic to hub airports outside of Europe, particularly in the Persian Gulf and the Bosporus. In the 2010 – 2023 observation period, the number of connecting passengers at non-EU hub airports grew from 37 % to 56 % in the Asia segment, and from 11 % to 30 % in the Africa segment. It was only in the airfreight segment that Germany was able to defend its leading position in Europe, even though tonnages decreased by 7 %. 10)

The airports organized in the German Airports Association (ADV) recorded significantly better traffic figures in 2023 than in the previous year. A total of 197.4 million airline passengers were processed (+19.4 %). This value was 21.3 % below the year 2019. At 4,695,499 tonnes (or –7.1 %), cargo volumes (airfreight and airmail throughput) did not reach the high of the previous year and lagged the year 2019 by 2.2 %. 11)

Economic environment Commercial Activities

Parking – Dependence on passenger volume and passenger mix

Demand for parking has risen in line with higher passenger volume. Compared to the pre-crisis period, more passengers arrived at the airport using individual transportation rather than public transport (55 % share of 2023 individual transports, constant compared to 2022). The high-revenue business passenger segment is still quite a bit smaller than it was in 2019. However, most of the shortfall was successfully compensated with higher volumes of individual travelers.

Retail sector grows mainly in the stationary segment

According to the Association of German Retailers (HDE), consumption saw only moderate growth in 2023, rising 2.9 % to € 649.1 billion (which represents a real decrease of 3.4 % compared to the previous year). Most of the nominal growth was generated in the stationary retail segment (2023: +3.5 %). 12)

Business sentiment in the retail sector worsened considerably. It declined by almost 7 percentage points compared to 2023. 13)

Gastronomy and hotel industry – Subdued revenue development

Compared to the previous year, revenue in the food and hotel sector saw little growth (8.5 % nominally, and 1.1 % on a price-adjusted basis). 14)

Some industry sectors changed as follows compared to the previous year: in the hotel and other accommodations sector, revenue grew by 10.8 %, which corresponds to a revenue of 4.5 % on a price-adjusted basis. The gastronomy sector recorded a revenue increase of 7.2 % (real –0.9 %), and the catering sector recorded an increase of 12.1 % (real 1.8 %).14)

Advertising industry – Growth in out-of-home advertising slows

Compared to the previous year, revenues generated by the advertising category «Out-of-Home», which is relevant to the airport, increased by around 9 % to reach almost € 3 billion. 15)

Economic environment Real Estate

Munich’s office leasing market with historically low annual result

The office leasing market in Munich started to feel the impact of the recessionary economic situation in 2023. Take-up of 474,800 m² was the lowest result since 1997 (2022: 754,400 m²). With a figure 448,300 m², lease revenues excluding owner-occupiers were 33 % below the previous year’s value (671,700 m²), with 41 % generated inside the Mittlerer Ring (Middle Ring), 34 % in urban district locations and 25 % in the surrounding area. 16)

Vacancies in the entire market (including surrounding areas) increased to 6.9 % (Dec. 31, 2023: 1.57 million m²) compared to the previous year (Dec. 31, 2022: 1.23 million m²). With a vacancy rate of 1.2 %, there was still a shortage of space in the historic section of town. Inside the Mittlerer Ring, the supply of space was moderate with a vacancy rate of 3.5 %. However, vacancy rates rose noticeably in some areas of the city. Between the Mittlerer Ring and city limits, vacancy rates of 8.3 % were similar to those of the surrounding area, where 9.5 % of the available space inventory was available on short notice. 16)

The new build segment accounted for 30 % of lease revenues (previous year: 45 %). This led to a sideways movement in the average lease amount, which was approximately 1 % lower than in the previous year (23.80 €/m² compared to 24.20 €/m² in 2022). At the same time, record values of well above 50.00 €/m² were achieved in the top segment. New builds in the city achieved 29.10 €/m² on average (2022: 30.50 €/m²). 16)

As building starts became almost impossible to finance without pre-leasing, very few speculative properties were built in 2023. Because of the steep downturn in construction activity, the total current volume decreased to approximately 708,100 m² of office space, only 67 % of which is occupied. Of this figure, 490,400 m² will be completed in 2024, with vacant premises totaling approximately 175,000 m². This means that vacancy rates will probably continue to rise in 2024. 16)

Overall, the slump in demand was greater than expected. In the entire Munich market, only five lease agreements were recorded for the large user segment with leases of more than 5,000 m². Nonetheless, there is still general activity in Munich. Having said that, large users in particular are more cautious about leasing during periods when economic activity is weak. This trend is still expected to be very noticeable in the first half of 2024. 16)

Course of business

Key events in the past fiscal year

Upward trend despite economic turbulences

Overall, the year 2023 was dominated by numerous challenges: Despite intensive recruiting measures, it was not possible to always acquire the planned personnel resources, particularly in the personnel-intensive operating segments. As a result, aircraft and baggage handling, as well as security services, experienced personnel shortages during peak periods and periods of extreme weather. Accordingly, production capacities became the main limiting factor at this location (the same applies to airlines, service providers and government agencies).

The energy supply situation (still classified as critical in the previous year) eased in 2023, and stabilizing prices provided planning security. Revised emergency and back-up plans also improved the resilience and response time of Munich Airport.

The airport continued to pursue its strategy of focusing on the core business of airport operations and its direct ancillary businesses. To this end, it also reduced its investment portfolio.

Despite the difficult economic environment, the recovery in traffic volumes was quite significant in 2023, with strong growth in all areas. In addition to special effects, this also meant that Munich Airport was once again able to achieve positive earnings after taxes for the first time since 2019.

Opening of Terminal A in Newark

The new Terminal A at Newark Liberty International Airport, the operation of which is the responsibility of approximately 130 employees of Munich Airport New Jersey, successfully started regular operations in January 2023. The state-of-the-art building offers airline passengers many comforts, also due to the consistent use of digital technologies. It also exhibits regional art works, and 60 different providers (with many hailing from the New Jersey region) will also offer a variety of food and shopping options. Every year, up to 13.6 million passengers are expected to be processed efficiently through the 33 gates.

Official opening of first quarters at the LabCampus

The LabCampus, which is located in the western part of the airport grounds, is a large innovation campus spanning some 500,000 m², which will offer the ideal collaboration environment for international groups, hidden champions and young companies. The first quarter with the two completed buildings LAB 48 and LAB 52 with the Airport Academy was opened in July 2023.

Aviation business

Significant recovery in traffic figures in 2023

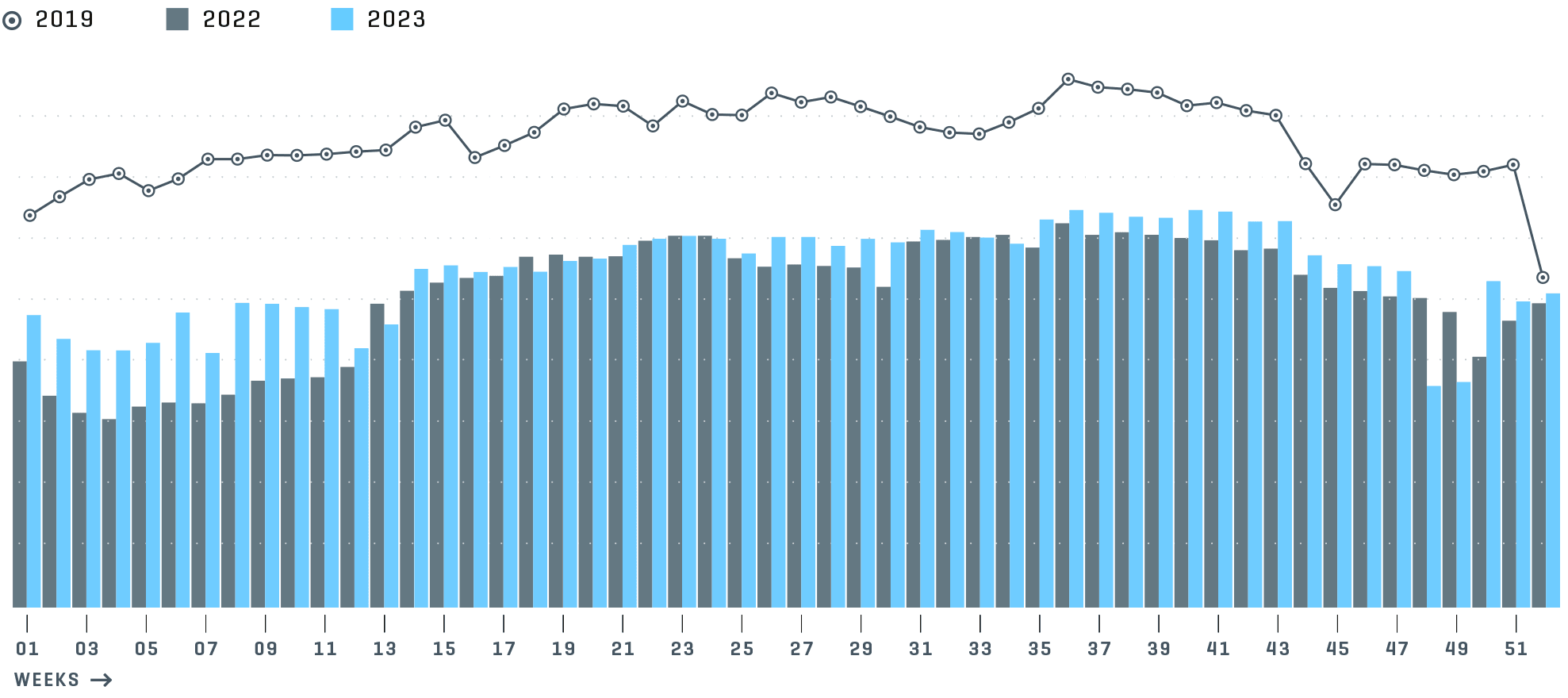

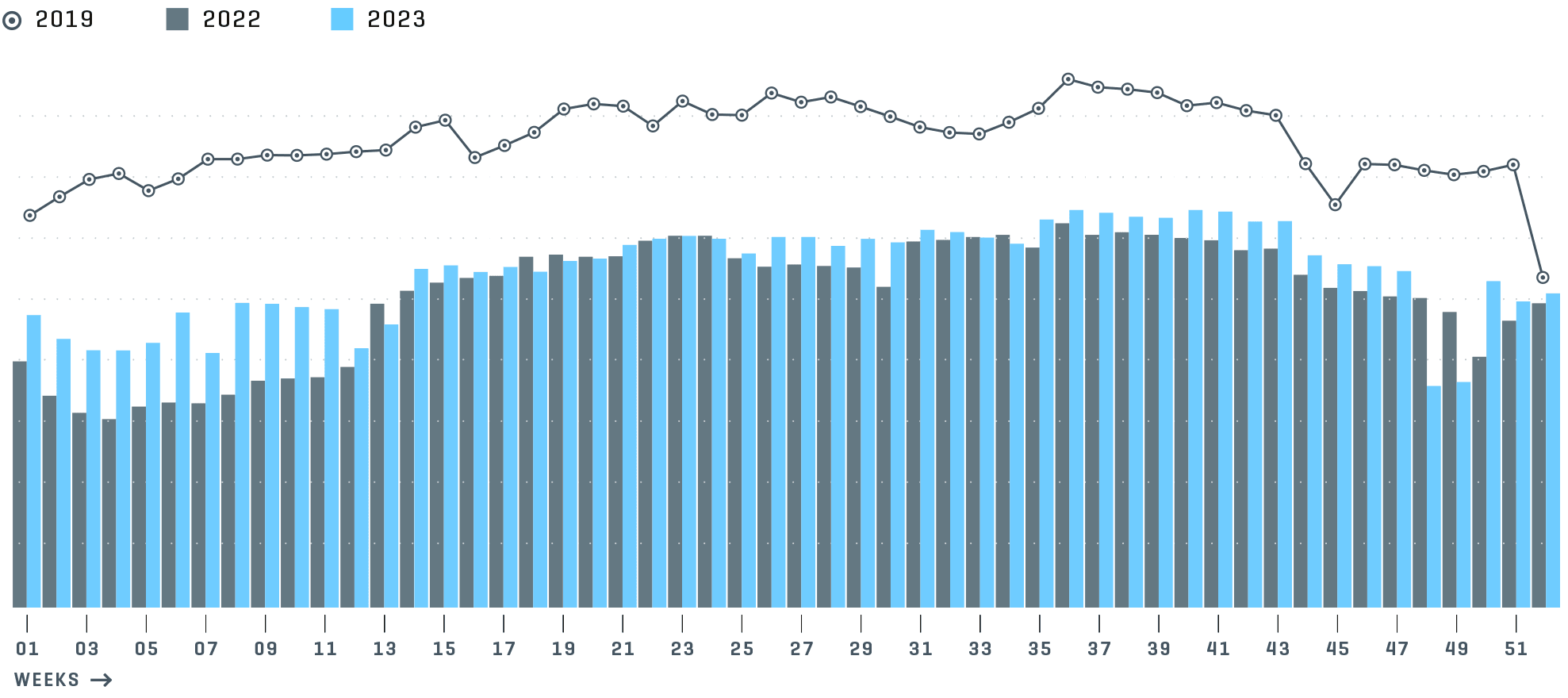

Over the entire year of 2023, traffic trends were at times well above the previous year’s result. However, the values of the pre-crisis period were not reached.

Traffic figures Munich Airport 1)

| Change | ||||

|---|---|---|---|---|

| 2023 | 2022 | Absolute | Relative in % | |

| Aircraft movements | 302,150 | 285,028 | 17,122 | 6.0 |

| Passengers (in millions) | 37.0 | 31.7 | 5.3 | 17.0 |

| Airfreight throughput (in tonnes) | 277,199 | 258,857 | 18,342 | 7.1 |

| Airmail throughput (in tonnes) | 7,147 | 7,921 | –774 | –9.8 |

- Deviations possible due to rounding

With 37.0 million airline passengers (+17.0 %) and 302,150 aircraft movements (+6.0 %), traffic figures at the Munich Airport increased markedly over the previous year. Still, passenger figures and movements were only 77 % and 72 % of the values in the 2019 reference year, respectively.

Munich Airport started the year 2023 at a much higher level than in the previous year. A recovery trend, which was already noticeable during the Easter holidays, continued to gain traction as of Whitsunday. Extremely high utilization rates and high ticket prices showed that it was sometimes difficult to meet the demand.

The lifting of travel restrictions in almost all countries around the globe led to a significant recovery in long-haul traffic. Some destinations, such as the US, already surpassed the 2019 reference period at the start and during the course of the year. The important Asian market was mixed. Because of travel restrictions, China was well below pre-crisis levels, while smaller markets such as India or Thailand surpassed the levels seen before the crisis. In 2023, almost 7 million commercial passengers were transported in the long-haul segment (31 % compared to 2022, but 17 % lower than in 2019).

In 2023, almost 6 million commercial travelers were transported within Germany (19 % higher compared to the previous year, but 40 % lower than in 2019). Over the course of the year, domestic traffic continued to recover, mainly as a result of growing demand in the business travel segment, despite high ticket prices.

Continental traffic also saw a significant recovery. Approximately 24 million commercial airline passengers used Munich Airport, which corresponds to an increase of 13 %. At the same time, passenger volumes were still 19 % lower than in the 2019 reference year. Capacity utilization reached a new record of 81 % across all segments (2019 and 2022: 77 %). The hub traffic of Deutsche Lufthansa, which accounted for 41 % of connecting passengers, was an important reason behind this development (2022: 43 %; 2019: 39 %).

Similarly, commercial airfreight throughput also improved by 7.1 % over the previous year (to 277,199 tonnes), which was only 16 % below the pre-crisis level. As the long-haul passenger segment improved, bellyhold cargo volumes handled in Munich increased by 11 % compared to 2022 (216,611 tonnes; –24 % compared to 2019). The share of bellyhold cargo out of the total freight volume increased to 78 %, which was almost as high as the levels normally seen before the crisis (around 80 %). Generally speaking, the demand for airfreight decreased globally during the observation period. However, the freight market stabilized again by the end of the year. Munich continues to benefit from catch-up effects.

Airmail throughput decreased to approximately 7,147 tonnes (–9.8 %) and only reached 39 % of the 2019 volume.

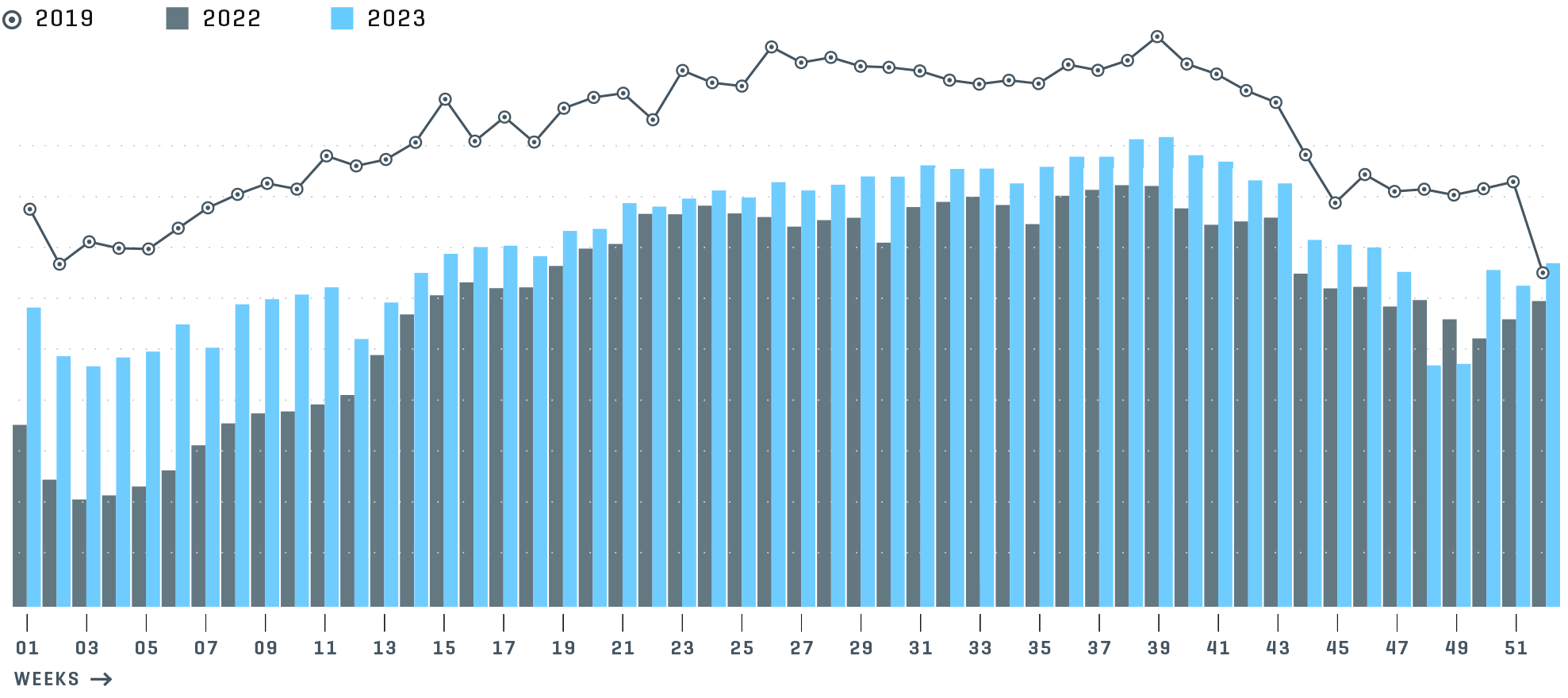

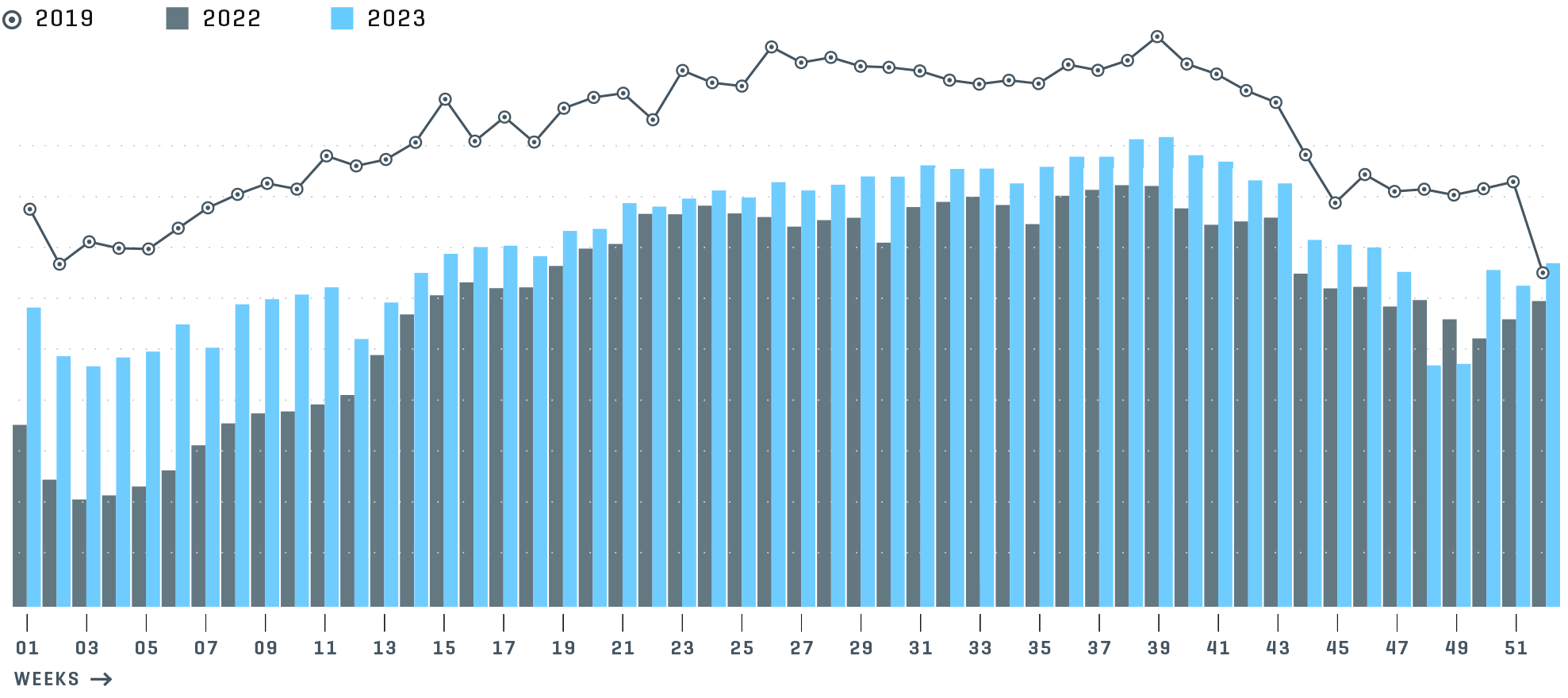

Aircraft movements at Munich Airport during the year (commercial traffic)

Aircraft movements per calendar week

Compared to the airports organized in the ADV, in 2023 Munich Airport saw above-average growth in terms of freight volumes, but slightly below-average growth in aircraft movements and passenger traffic (all in relation to the previous year). Until November, cumulative aircraft movement volumes were still above the ADV average, but the extreme winter weather in December had a disproportionately negative effect on the traffic result in Munich. Strong passenger and movement growth at the Frankfurt airport dominated the developments in the German market. Significant catch-up effects and the growing strength of the location were noticed particularly in the airfreight segment in Munich. As passenger hub traffic recovered, bellyhold cargo also increased along with continued high freight-only volumes (–4 % compared to 2022, but +32 % compared to 2019).

Traffic 2023 1)

in %

| ADV | Munich | |

|---|---|---|

| Movements (total traffic excluding non-commercial traffic) | +6.6 | +6.3 |

| Airline passengers (commercial traffic) | +19.4 | +17.0 |

| Cargo (airfreight and airmail including transit) | –6.8 | +5.2 |

- ADV-12.2023_Monthly-Statistics_Airports

Passenger development at Munich Airport during the year (commercial traffic)

Passengers per calendar week

The ranking of European airports with the highest passenger volumes has seen extreme changes since the start of the pandemic, not to mention the impact of the Russian attack on Ukraine. Measured by 2023 passenger volume and aircraft movements, Munich holds the 10th and 8th place in the ranking of European airports with the highest traffic volumes. 17)

Ground handling services in a difficult economic environment despite recovery

The subsidiary AE Munich increased handling numbers in 2023. This development was mainly due to the continued recovery in air traffic. However, the war between Russia and Ukraine continued to have the opposite effect.

There are two ground handling licenses at Munich Airport. One of these is permanently assigned to AE Munich. In 2023, AE Munich was able to increase handling volumes by 8.9 % due to the recovery in traffic. Market share increased slightly by +0.7 percentage points to reach an average of 61.4 % in 2023.

Commercial Activities business

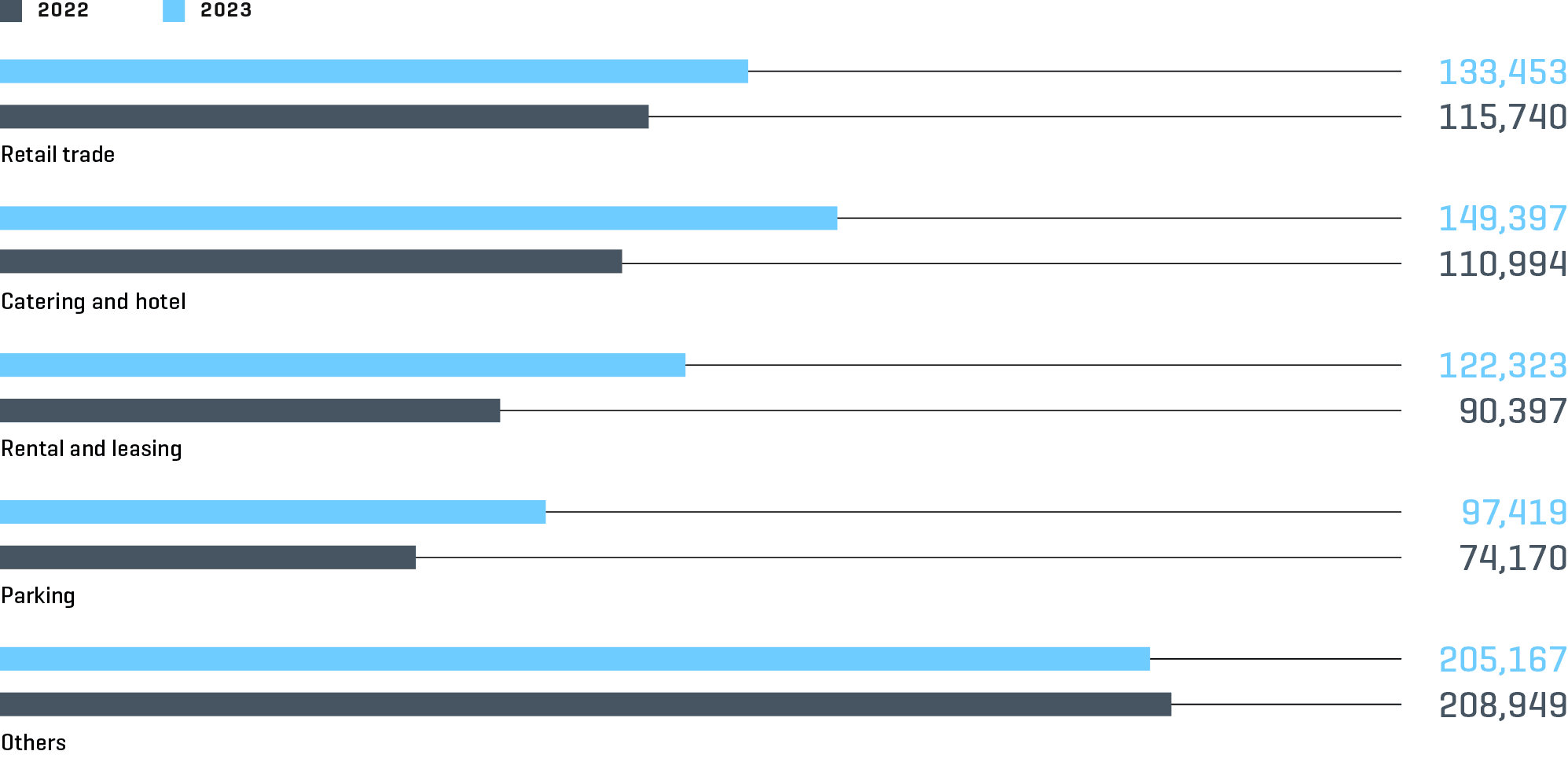

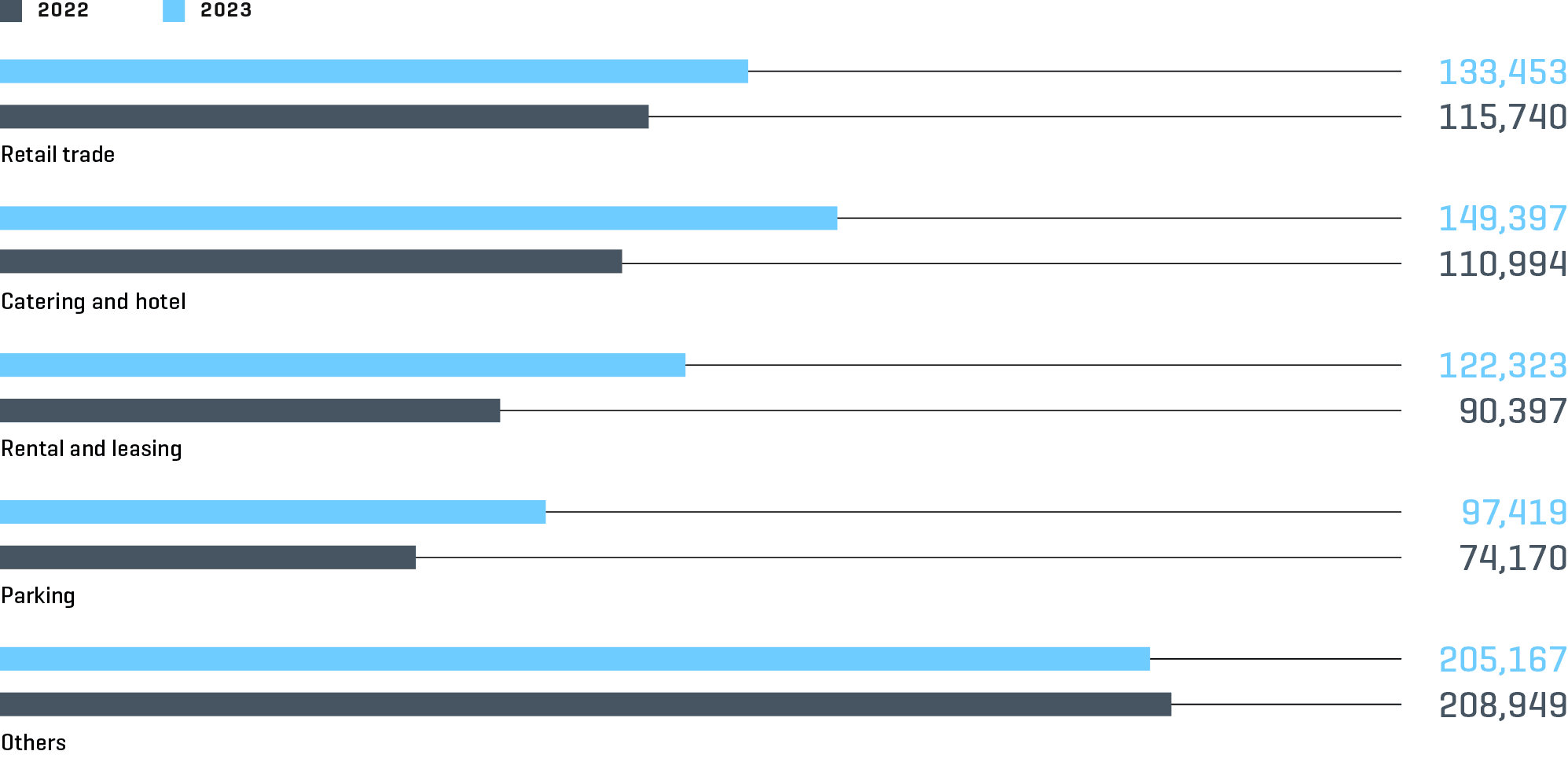

Revenue in the Commercial Activities business unit grew by 18.7 % compared to the previous year, partly as a result of the recovery in passenger volumes.

Parking – Disproportionate revenue growth compared to local passenger volume

In 2023, revenue in the area of parking and mobility grew by 24.5 % compared to the previous year’s period; revenue growth was disproportionate to passenger numbers when compared to 2022. At the same time, revenues have declined by 21 % when compared to the pre-crisis level of 2019, which corresponds to a disproportionate revenue trend with regard to O&D passenger developments (–23 %).

As renovations continue and parking spaces are not available, the capacity situation remains tense particularly in the central zone.

The rental car business performed well in line with growing passenger volumes. The shortage of vehicles, which drove revenues in the previous year, no longer existed as such in 2023. However, there were challenges with regard to existing capacity bottlenecks, and the first indications of limits to volume growth. The passenger-dependent tenant parking business remained virtually unchanged, other than a price adjustment due to inflation.

Retail – Revenue growth disproportionate to passenger developments

At an absolute level, revenues in the retail segment grew by 15.4 % compared to the previous year. Revenue per passenger shrank by 1.5 %, which reflects the generally cautious purchase behavior due to high inflation. Moreover, the strike days at the largest retailer eurotrade also had an effect. Moreover, Munich Airport continues to see only small numbers of wealthy international passengers from destinations such as China, Russia and the Ukraine.

Revenue growth in the gastronomy and hotel segment disproportionate to passenger developments

On an absolute level, revenues in restaurants and bars have risen 27.9 % over the previous year (+9.2 % per passenger). This is due to the fact that passengers spend more time at the airport, as well as price increases due to inflation.

The hotel reported higher revenues due to higher demand for overnight stays and conferences in connection with the completion of remodeling measures at the end of 2022. At the Skytrax Awards 2023, the five-star hotel in the central area of Munich Airport was named the second-best airport hotel in Europe. 18)

Advertising – challenging market environment

Contrary to the industry trend, advertising revenues at the airport grew by 5.1 %. This development is mainly due to the large number of bookings at the end of the year.

Real Estate business

Ongoing site and real estate development

At this time, Munich Airport is building another hotel on the parcel that borders Novotel to the south, after construction had been delayed to the coronavirus pandemic. The project consists of an iBIS budget hotel with 358 rooms. Construction approval was obtained in the spring of 2023. The structural work began in May 2023. Work progressed so well that interior construction on the first floor was started in the fourth quarter of 2023. The hotel is expected to begin operations in early 2025.

The construction work for the new pier that will be added to Terminal 1 progressed well in 2023. Interior construction activities, which began in the first quarter of 2023, also included the installation of all escalators. The baggage claim in Module B was also decommissioned in June; it has been gutted since that time. This area is supposed to become a modern entrance area that is the central entry and exit point to the pier. Floor screed works inside the building started in November. In addition, planning for the interior construction comprising the retail and gastronomy units as well as the central market place at the pier also started in 2023. The pier is expected to be commissioned by mid-2026 at the latest.

The construction of two parkades was initiated to address the growing demand for parking capacities in the area of AirSite West. While P44 (2,000 parking spaces) already opened in 2021, P43 (1,800 parking spaces) was still under construction at the end of 2023; it was commissioned in the first quarter of 2024. The demolition of P8 in the central zone was completed in 2023. Initial building works for the new P8 began in the fourth quarter of 2023.

There were new personnel developments in the «FMG and Housing» project: In 2023, a room contingent was leased in Lilienthalstraße in Hallbergmoos, in order to address the demand for adequately priced living space for new employees. In addition, negotiations to expand space capacities by leasing another part of the building are currently under way.

Some traffic infrastructure projects were successfully implemented in 2023. For example, the renovation of transport hub West 1 (bridge structure) was completed in the fourth quarter. Moreover, the Nordring was renovated in the context of building sections 2 and 3, which led to the completion of the project. The «S-Bahntunnel» (suburban train tunnel) project also progressed (second building section) to the point where it reached approval-ready status for transfer to Deutsche Bahn.

Results of operations, assets, and financial position

Results of operations

Earnings after taxes– Return to growth

In fiscal year 2023, Munich Airport’s earnings after taxes (EAT) improved significantly by TEUR 84,142 to TEUR 25,348. The various developments are explained in detail below.

Results of operations

in TEUR

| Change | ||||

|---|---|---|---|---|

| 2023 | 2022 | Absolute | Relative in % | |

| Revenue | 1,373,301 | 1,187,988 | 185,313 | 15.6 |

| Other income | 43,201 | 45,337 | –2,136 | –4.7 |

| Total revenue | 1,416,502 | 1,233,325 | 183,177 | 14.9 |

| Cost of materials | –461,641 | –421,965 | –39,676 | 9.4 |

| Personnel expenses | –541,586 | –500,035 | –41,551 | 8.3 |

| Other expenses | –95,614 | –72,672 | –22,942 | 31.6 |

| EBITDA | 317,661 | 238,653 | 79,008 | 33.1 |

| Depreciation and amortization | –202,790 | –266,400 | 63,610 | –23.9 |

| EBIT | 114,871 | –27,747 | 142,618 | >100.0 |

| Financial result 1) | –74,608 | –37,611 | –36,997 | 98.4 |

| EBT | 40,263 | –65,358 | 105,621 | >100.0 |

| Income taxes | –14,915 | 6,564 | –21,479 | >100.0 |

| EAT | 25,348 | –58,794 | 84,142 | >100.0 |

- this also includes the results from companies accounted for using the equity method.

The noticeable traffic recovery in 2023 led to an increase in revenue from airport charges from TEUR 445,565 to TEUR 516,363 (+15.9 %). Nevertheless, revenues are below the 2019 pre-crisis year.

Revenues from handling services also increased by TEUR 7,005 to TEUR 149,179 as a result of higher aircraft movements and passenger volumes.

Revenue in the other divisions developed as follows:

Breakdown of revenues of other areas

in TEUR

Other revenues include global management, consulting and training services for the aviation industry, as well as utility services and fuel.

After more than 30 years of operation, the need for renovation of the buildings from the first expansion phase of Munich Airport continues to grow. Accordingly, expenses for renovation, optimization and remodeling measures grew by TEUR 11,571 to TEUR 128,956. The remaining items in the cost of materials increased mainly as a result of the significant increase in air traffic at the Munich location. Overall, the cost of materials increased by TEUR 39,676 (9.4 %).

Personnel expenses at Munich Airport increased by 8.3 % to TEUR 541,586, mainly due to wage tariff increases and numerous measures for providing financial support to employees. These mainly consisted of allowances for critical areas, relief programs and premiums. The number of employees decreased from an average of 8,543 to 8,193 persons.

Other expenses (TEUR 95,614) were well above the previous year’s level (+31.6 %), mainly because of higher audit, consulting and project costs, higher expenses for advertising and public relations activities, and higher contributions and fees for public utility services and other fees.

The reduction in depreciation and amortization by TEUR 63,610 is mainly due to lower impairments of assets (TEUR 6,483; 2022: TEUR 59,715). The previous year included mainly impairments on buildings in the amount of TEUR 42,889.

The financial result (including the result from companies accounted for using the equity method) deteriorated by TEUR 36,997 to TEUR –74,608. This development was due to the increase in interest expenses from loans.

Expenses related to income taxes are due to the positive results generated in the Group.

Assets and financial position

Financial position

in TEUR

| Change | ||||

|---|---|---|---|---|

| Dec. 31, 2023 | Dec. 31, 2022 | Absolute | Relative in % | |

| Non-current assets | 5,272,539 | 5,264,038 | 8,501 | 0.2 |

| Current assets 1) | 407,057 | 213,036 | 194,021 | 91.1 |

| thereof cash and cash equivalents | 11,201 | 30,811 | –19,610 | –63.6 |

| Assets | 5,679,596 | 5,477,074 | 202,522 | 3.7 |

| Equity | 1,786,679 | 1,765,672 | 21,007 | 1.2 |

| Other non-current liabilities 2) | 2,636,230 | 2,566,391 | 69,839 | 2.7 |

| Other current liabilities 2) | 1,256,687 | 1,145,011 | 111,676 | 9.8 |

| Equity and liabilities | 5,679,596 | 5,477,074 | 202,522 | 3.7 |

- Including assets held for sale

- Including financial liabilities from partnerships

Assets – Liquidity continues to be guaranteed

Non-current assets are dominated by owner-occupied property, plant and equipment (TEUR 4,975,302; previous year: TEUR 4,983,574) and investment property (TEUR 206,434; previous year: TEUR 198,774).

The increase in current assets (TEUR +194,021) is mainly due to the increase in liquidity reserves (TEUR +169,459) to TEUR 201,442 in connection with borrowings through loans at the end of the 2023 fiscal year. Moreover, trade receivables also increased by TEUR 32,365 to TEUR 112,466.

The increase in equity to TEUR 1,786,679 is mainly due to the consolidated net profit for the current financial year (TEUR 25,348).

Non-current liabilities include TEUR 475,000 in loans that were obtained in the middle of December 2023. On the other hand, loan repayments totaling TEUR 388,450 were made on schedule. Further loan repayments will be due in the 2024 fiscal year. This has resulted in the shifting of financial liabilities from non-current to current. Overall, the balance of current liabilities as of the closing date is TEUR 709,101 (previous year: TEUR 399,899).

Capital structure

in TEUR

| Change | ||||

|---|---|---|---|---|

| As of Dec. 31, 2023 | As of Dec. 31, 2022 | Absolute | Relative in % | |

| Subscribed capital | 306,776 | 306,776 | – | – |

| Reserves | 131,610 | 113,819 | 17,791 | 15.6 |

| Other equity | 1,348,273 | 1,345,057 | 3,216 | 0.2 |

| thereof profit/loss of the year | 25,348 | –58,794 | 84,142 | >100.0 |

| Non-controlling interests | 20 | 20 | – | – |

| Equity | 1,786,679 | 1,765,672 | 21,007 | 1.2 |

| Financial liabilities from interests in partnerships | 398,780 | 382,357 | 16,423 | 4.3 |

| Shareholder loans 1) | 518,315 | 512,794 | 5,521 | 1.1 |

| Fixed-rate loans | 1,794,820 | 1,707,533 | 87,287 | 5.1 |

| Floating-rate loans | 465,809 | 464,692 | 1,117 | 0.2 |

| Loans | 2,260,629 | 2,172,225 | 88,404 | 4.1 |

| Derivatives | 1,920 | 438 | 1,482 | >100.0 |

| Other liabilities | 713,273 | 643,588 | 69,685 | 10.8 |

| Financial liabilities | 3,892,917 | 3,711,402 | 181,515 | 4.9 |

| Equity ratio | 31.5 % | 32.2 % | ||

- including deferred interest

Compared to the previous year, the equity ratio fell slightly by 0.7 % to 31.5 %.

The main terms of Munich Airport’s current and non-current financial liabilities can be found in the table below:

Non-current land current loans conditions

as of Dec. 31, 2023

| Interest rate in % | |||||

|---|---|---|---|---|---|

| Method of funding | Currency | Interest rate | Residual debt in TEUR | from | to |

| Financial liabilities from interests in partnerships | EUR | Earnings-based | 398,780 | – | – |

| Shareholder loans | EUR | variable/earnings-based | 491,913 | Base rate plus margin | |

| Loans | EUR | Floating-rate | 466,324 | 3M and 6M-EURIBOR plus margin | |

| Loans | EUR/USD | Fixed-rate | 1,794,055 | 0.16 | 5.95 |

The shareholder loans have a due date of 2024 to 2025 and bear interest at the base rate plus a margin.

The loans have a final due date of 2024 to 2033.

The loans are subject to the usual non-financial covenants, including pari passu declarations. In addition, there are other general conventional agreements concerning repayment in the event of changes in the shareholder structure. No financial covenants have been agreed.

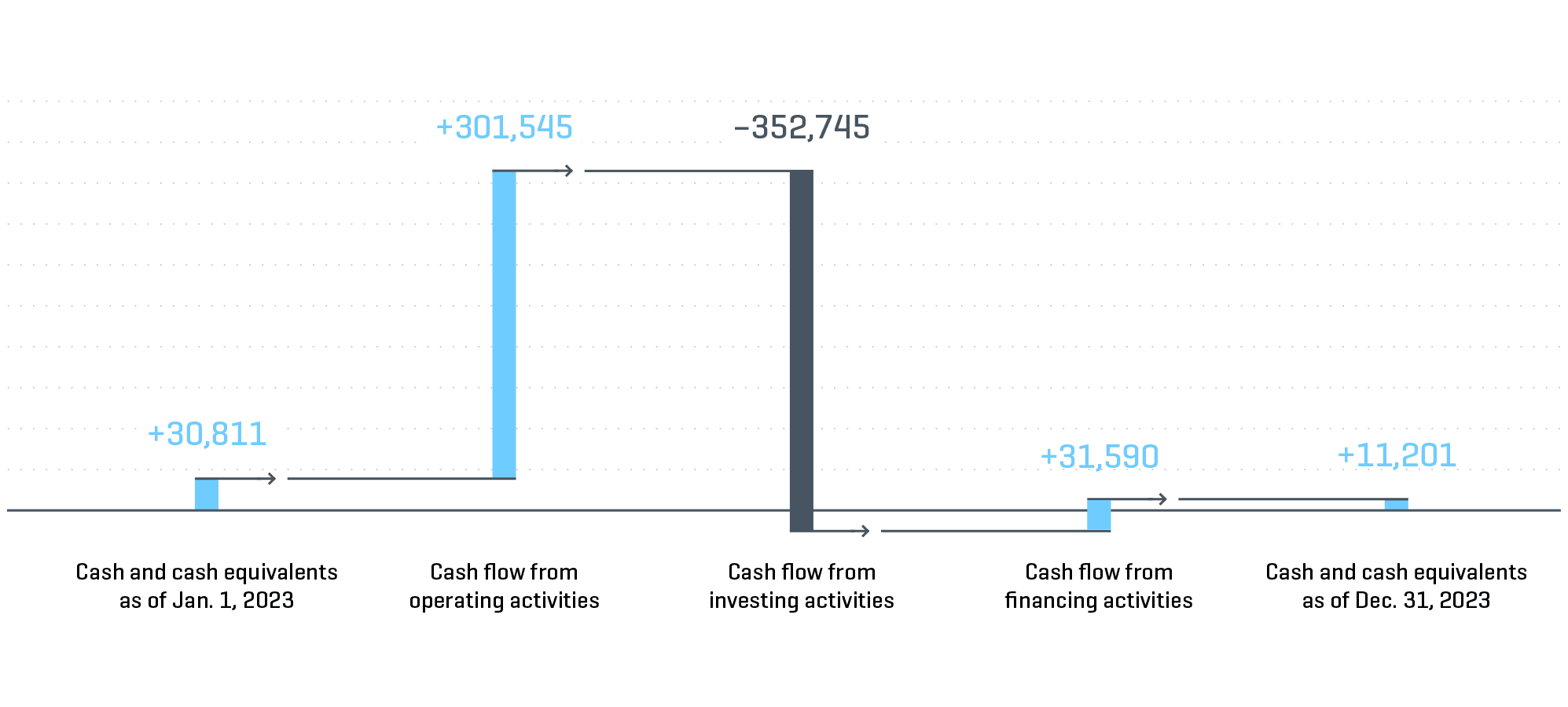

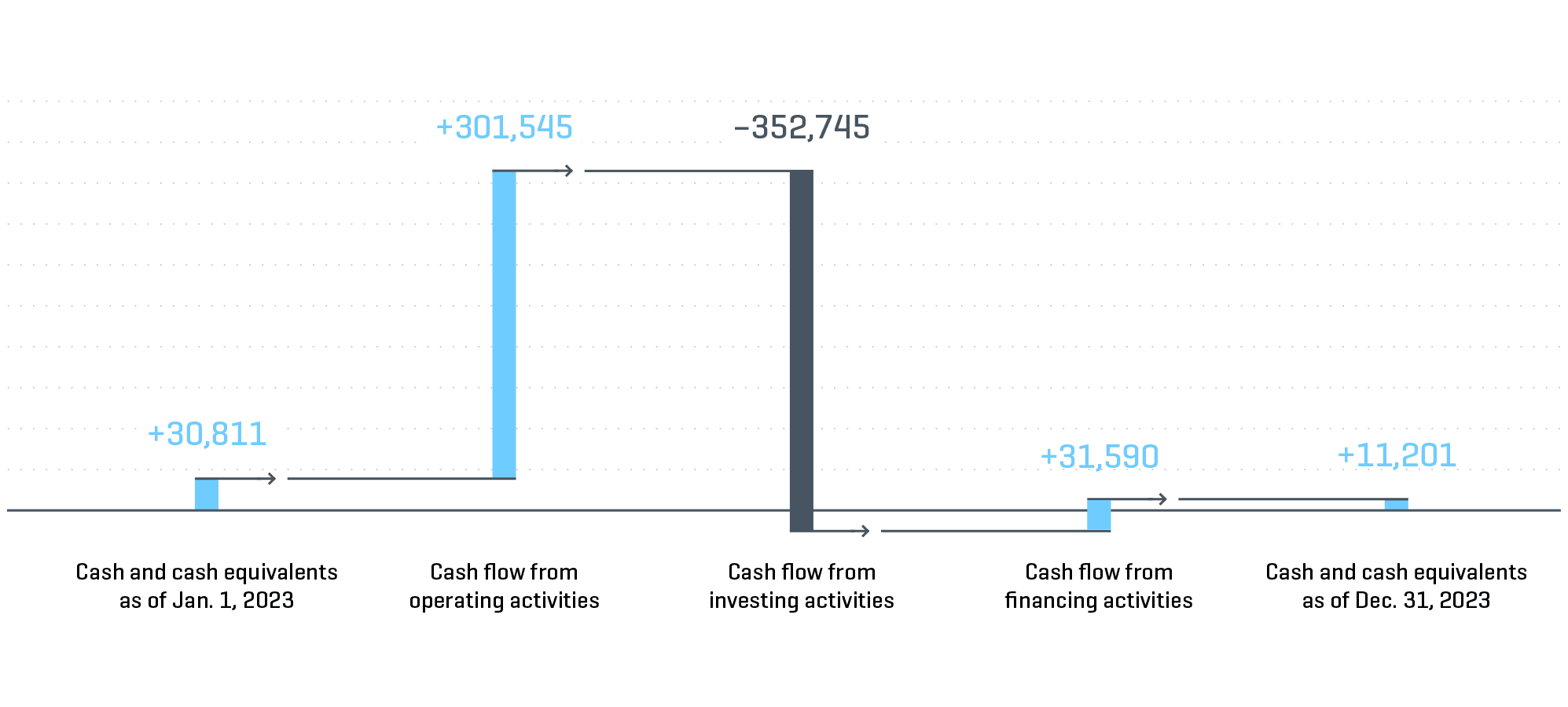

Liquidity

Due to improved traffic developments as well as strict cost management, the cash flow from operating activities grew significantly during the 2023 fiscal year (previous year: TEUR +159,426).

The cash outflow from investing activities resulted primarily from investments in construction projects and short-term deposits.

Compared to the previous year, the cash inflow from financing activities increased by TEUR 12,019 to TEUR 31,590, mainly because of long-term financial liabilities to secure liquidity.

Statement of cash flows

in TEUR

Target achievement and overall assessment

Year on year and in comparison with the forecast development, the performance indicators have trended as follows:

Forecast/actual comparison

| 2022 | 2023 | 2023 | ||||

|---|---|---|---|---|---|---|

| Actual | Forecast | Actual | ||||

| from | to | |||||

| in % | in % | |||||

| EBT [in TEUR] | –65,358 | Increase | 10.0 | 30.0 | 40,263 | Exceeded |

| Carbon reductions (in tonnes) 1) | 3,216 | Decrease | –38.0 | –33.0 | 2,852 | Exceeded |

| Passenger Experience Index 2) | 80.4 | Unchanged | 0.0 | 0.0 | 78.8 | Not achieved |

| Lost Time Incident Frequency (LTIF) 3) | 19.9 | Decrease | 0.0 | 2.0 | 16.0 | Exceeded |

- The average consumption values from 2019 are used to calculate the carbon reductions that are generated from the replacement of vehicle types.

- The value refers to the question about overall satisfaction.

- Applies to FMG and AE Munich; 2019 (LTIF: 21.96) was used as the reference period.

Earnings before taxes (EBT)

Munich Airport’s EBT for the 2023 fiscal year shows that the planned figure was significantly exceeded. This is mainly due to the positive special effects in the energy and utilities segment and the lower-than-planned workforce.

Despite the difficult economic environment, the recovery in travel volumes was quite significant in 2023, with massive growth in all areas. In addition to special effects, this also meant that the Munich Airport once again generated positive earnings before taxes for the first time since 2019.

Carbon reductions

Binding targets are agreed annually in order to achieve the long-term climate protection goals. They include stipulations regarding the implementation and recognition of efficiency measures, and special targets for the development of CO2-reducing technologies. One example is the conversion to energy-efficient LED lighting in all building categories (terminal, hotel, office, parkade etc.).

The last few years were characterized by a large number of measures in the ventilation and air-condition technology segment. In 2023, the greatest savings in electricity (around 4.7 GWh) were generated in the lighting segment, followed by ventilation and air-condition technology. Compared to 2022, the emission factor for electricity increased by approximately 15 % to 435 g/kWh, which alone resulted in higher carbon reductions.

Renovation measures for the building shells of the freight building and the hangar led to heat savings in 2023. This has resulted in annually recurring heat savings of approximately 0.8 GWh.

While the target «Climate-neutral airport operations 2030» included specifications for emission savings in the amount of 2,000 tonnes of CO2 in the year 2023, the new climate target «Net Zero Emissions» requires savings of 2,680 tonnes of CO2 in order to reach the specified targets. The efficiency measures completed in 2023 achieved savings of 2,852 tonnes of CO2 (which are calculated for the entire financial year).

Passenger Experience Index (PEI)

Compared to 2022, in 2023 Munich Airport recorded a slight decline in passenger satisfaction as measured by the PEI. The low value was due to irregularities in operations, e.g. inclement weather, as well as a continued tense personnel situation coupled with a continued increase in traffic figures compared to the previous year, which sometimes resulted in non-compliance with service standards.

The London-based aviation research institute Skytrax once again named Munich Airport a 5-Star-Airport in 2023. In order to meet the requirements of a 5-Star-Airport, Munich Airport once again implemented measures to improve the passenger experience in 2023. For example, large monitors were installed at six locations in Terminal 1 and in the central area; they display information about all relevant mobility offerings at the airport. They also provide travelers with access to the real-time data of various services and providers. In addition, Munich Airport also implemented measures to increase process quality, including the installation of the new CT scanners for the security checks in Terminal 1 and 2, or the digitization of processes such as the use of biometrics, particularly in Terminal 2.

Lost Time Incident Frequency (LTIF)

In 2023, the LTIF for FMG and AE Munich was 16.00, which greatly exceeded the forecast value of 20.05. Compared to 2022, the LTIF decreased by 20 %. This decline is due to the large reduction in occupational accidents (–16 %) with a simultaneous increase in hours worked (+5 %). A comparison of the LTIF for 2023 and 2019 before the beginning of the COVID–19 pandemic (21.67) reveals that the accident frequency has decreased significantly.

- ifo Institute, Economic Forecast Winter 2023, December 2023; German Council of Economic Experts, Annual Report 2023/November 24, 2023

- www.onvista.de

- IATA-Air Passenger Market Analysis December 23/Different calculation of capacity utilization according to airline standard, Seat kilometer sold/Seat kilometer offered leads to higher values, no comparability with seat capacity utilization (airport method).

- IATA-Air Cargo Market Analysis December 2023

- ACI Airport Traffic Forecast Revised 2023–2027 Outlook

- Eurocontrol-European-aviation-overview-20240118-2023-review

- 20240207 BDL PM Annual Figures 2023

- ADV, ADV-12.2023_MoSta-Flughäfen

- HDE, Annual Press Conference 2024

- ifo Business Climate Germany by Economic Sector

- Press Release No. 064 dated February 20, 2024 – Federal Statistical Office

- Press Release Fachverband Außenwerbung – January 16, 2024

- Colliers: Munich’s office leasing market with «historically low annual result»– Press Release from January 9, 2024

- ACI-2023-13 Munich Airport Ranking

- SKYTRAX, World’s Best Airport Hotels 2023, November 2023